Payment system brands are offering strong incentives in return for credit card payments. This makes credit cards a preferred way of making payments. If you are in business today you probably accept credit card payments. While it is relatively easy to get started accepting credit cards, it's not as easy to get the lowest rate and maintain PCI compliance. There are 5 basic items to look for in a payment system provider.

David Harper

Recent Posts

4 min read

3 Critical Items to Look For in an Integrated Payment System

By David Harper on Aug 16, 2018 7:05:53 PM

3 min read

Sage 100cloud Integrated Payments

By David Harper on Aug 6, 2018 3:44:24 PM

5 Ways to Save and Get Paid Faster With Sage 100cloud Integrated Payments

Accepting credit cards is an essential part of doing business. The trick is to get the lowest credit card processing rate possible and make it as easy as possible for the customer to pay. Here are three ways to save money and get paid faster with Sage 100cloud integrated payments:

4 min read

Why Migrate from SSL and Upgrade TLS to 1.2 or Higher?

By David Harper on Jul 17, 2018 3:42:30 PM

These days most consumers feel confident using credit cards online through e-commerce shopping carts and transacting personal data with businesses. Since businesses are entrusted with consumer confidence and personal data, it’s vital to protect this data from cyber-attacks. When it comes to credit card processing, it requires constant oversight to protect their customer data and avoid becoming victimized by persistent criminals. This article is to inform you about why you need to migrate from SSL and upgrade to TLS v1.2 or higher for secure and compliant credit card payment processing.

2 min read

Automated Acumatica Credit Card Processing Makes Your Job Easier

By David Harper on Jul 6, 2018 4:32:46 PM

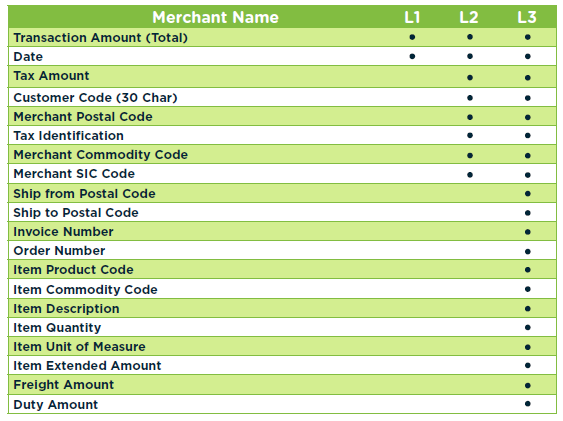

Integrated Acumatica level 3 automation makes your job easier and can reduce interchange rates

Acumatica users who process credit cards may be missing out on an easier way to do their job that actually saves the company money. With Acumatica credit card processing from APS Payments, you benefit from automation that makes your job easier and can lead to lower interchange rates. Here’s how:

2 min read

Here's what you missed from the SLA March 2018 Conference:

By David Harper on Jul 2, 2018 1:25:00 PM

Clouds and Subscription: Impact on Your Business Model

We all know the cloud has become one of the greatest disruptors in our business world today, with large enterprise technology companies reporting substantial profit increases driven by cloud operations, and smaller businesses feeling the impact of cloud computing on everything from supply chain management to pricing and sales models. Business models, hardware sales, and workflows are all shifting considerably to the point where many existing rules of the tech business are no longer relevant. The trend is most noticeable in the shift in tech business models away from hardware and proprietary software sales models, and toward subscription-based revenue models, where users pay for the right to use technology, but don’t ever actually own it.

3 min read

Sage 100 Level 3 Credit Card Processing

By David Harper on Jul 2, 2018 9:28:00 AM

Use Sage 100 level 3 credit card processing when accepting credit card payments to significantly reduce processing fees.

It's easy to accept electronic payments, it's more challenging to reduce fees. Our team at APS works diligently to get you the lowest credit card processing rates. We offer integrated Sage 100 Level 3 credit card processing in addition to our other level 3 ERP integrations. Our Sage 100 PCI-compliant security solutions feature point-to-point encryption (P2PE), tokenization, and our APSPAYS Vault, eliminating card data that typically would be stored on a local server.

We also walk our merchants through the PCI Compliance Self-Assessment Questionnaire (SAQ), eliminating the Non-PCI Compliance Fee most merchants pay every month.

4 min read

Is Your Business Ready for the Future of PCI Compliant Credit Card Processing?

By David Harper on Jun 21, 2018 9:51:04 PM

7 Growing Credit Card Processing Trends Transforming the Payments Industry

- In-store mobile payments are expected to overtake credit cards and grow from $75 billion to $503 billion in 2020

- The top mobile wallets used at small and medium businesses are Apple Pay (16.6%), Google Wallet (516.0%), Android Pay (%11.3%), and Samsung Pay (8.2%).

- The top 3 payment methods of online shoppers are credit cards (42%), electronic payment (39%), and debit cards (28%).

- There will be 27.7 million mPOS devices in circulation in the U.S. by 2021, an increase from 3.2. million in 2014.

- Over the next 5 years, blockchain technology is expected to reduce the costs of accounting reconciliation by 70% and compliance costs by 30-50%.

- Enhanced customer experience is the future of payments, as more than 60% of Millennial and Gen Z consumers are willing to share their bank account credentials with third parties.

- Biometric authentication such as fingerprint ID and facial recognition will be used in more than 18 billion transactions by 2021.

Source: http://paymentsjournal.com/7-trends-for-the-future-of-payment-processing/.

3 min read

Sage 100 TLS 1.2. PCI Compliance

By David Harper on Jun 13, 2018 12:52:43 PM

Our Sage 100 credit card processing integrations team works diligently to help keep our merchants’ data safe. For Sage 100 merchant processors, this means we need to ensure all our customers are following the PCI-DSS Regulations. On June 30th 2018, TLS 1.0, SSL V3 will no longer be a PCI approved method of running transactions. To maintain PCI Compliance, payment processors and gateway providers are removing security certificates, which will disable older versions of Sage 100 legacy software using this legacy encryption method. This means processing this way will not be considered PCI Compliant, and all transactions will stop working eventually.

2 min read

APS Supports TLS 1.2 in Sage 100 4.4, 4.5 and Subsequent Versions!

By David Harper on Jun 6, 2018 6:39:47 PM

According to posts on the internet and information gleaned from our Channel Partner Network it would appear that on May 2nd, 2018 Sage 100 versions 4.5 and prior, formerly MAS 90 and MAS 200, could no longer process credit cards through Paya, formerly, Sage Payment Solutions. Most companies on these versions of Sage 100 mentioned they had a processing blackout for over 24 hours, some even longer. It is currently unclear whether the companies using these versions have abruptly been forced to stop processing or whether they will be forced to stop processing as of June 30, 2018 the last day the card brands will allow transactions to flow on any TLS lower than TLS 1.2.

4 min read

Acumatica Credit Card Processing: PROS and CONS Behind Flat Rate or Tiered Pricing

By David Harper on Jun 4, 2018 1:08:06 PM

There are a few main types of credit card processing rates with their own advantages and disadvantages. There are flat rates, tiered pricing rates, interchange plus rates, Level 1, Level 2 and Level 3 processing rates.