Read this article before switching merchant service providers.

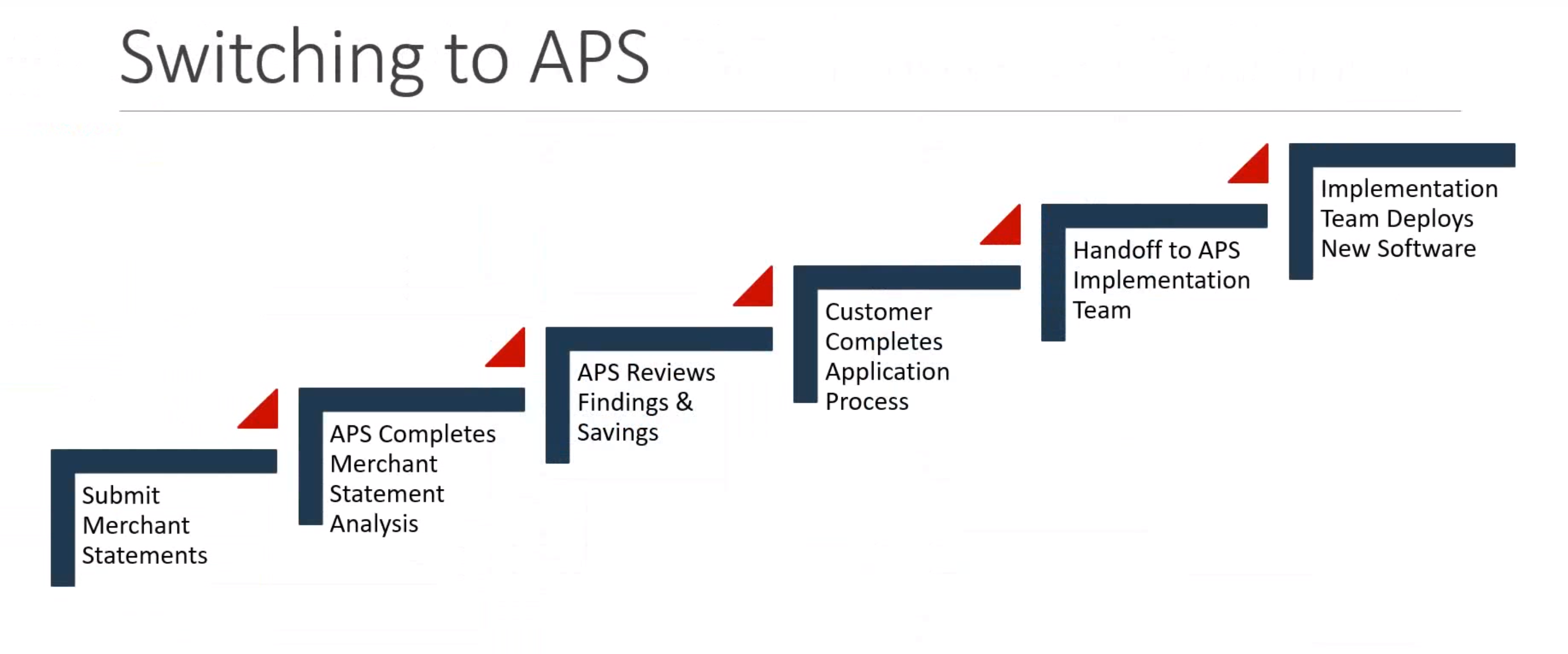

Switching merchant services providers may seem like a hassle if you are switching to save money it’s worth it and your new provider should make it as painless as possible. However, there a few important items to consider when making the switch. Credit card processing is a commodity, companies usually switch for a few main reasons; to get better rates, enhanced integration, superior support and/or to ensure PCI compliance.