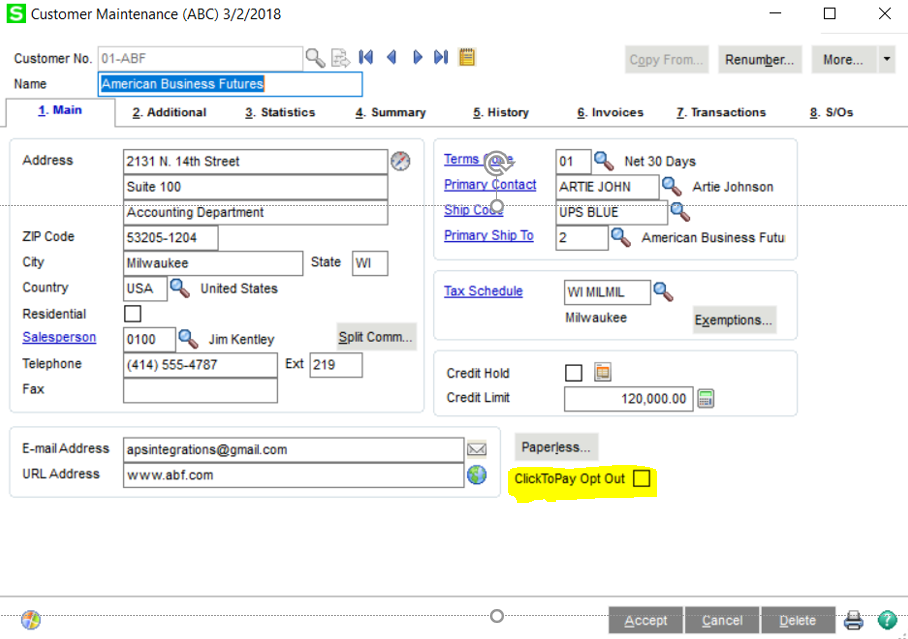

Sage 100 users now have the ability to get invoices paid almost as fast as their invoices are printed. It’s like adding a 24 hour a day collection agent to your staff. Customers demand convenience especially when it comes to paying for your products and services. ClickToPay is designed to help companies get paid faster for the products and services they offer. ClickToPay is a simple and secure credit card processing payment feature enabling your customers to pay invoices with the click of a button. Invoices are paid and processed online, anytime. It is super easy to set up in Sage 100 and also easy for your customers to use. Sage 100 users can rest assured that this automated process is PCI compliant and your customers information is secure.

Sage 100 credit card processing with ClickToPay includes complimentary lifetime upgrades and product support. There are no maintenance fees or billing limits either. In addition to all the benefits above ClickToPay reduces the use of paper, envelopes, stamps, fuel and most importantly time to process and collect payments. Now you can spend that time doing something more productive, increasing the bottom line of the company.

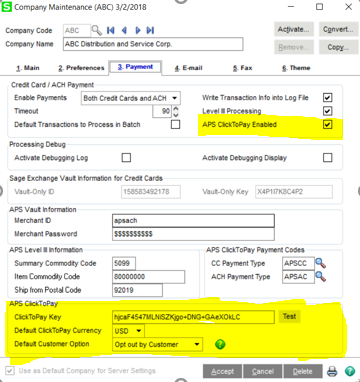

There are a few prerequisites to qualify for ClickToPay as follows:

- Sage 100 users must be using version 2013 or above (ACH also available as of version 2017)

- Sage 100 users must process through APS Payments

- Sage 100 Paperless Office must be turned on

Sage 100 credit card processing with ClickToPay also adds automated Level 3 credit card processing to reduce rates. ClickToPay uses the comprehensive invoice related customer data in Sage 100 to get the lowest rate. Our Sage 100 PCI-compliant security solutions feature tokenization, and our APSPAYS Vault, eliminating card data that typically would be stored on a local server. We also walk our merchants through the PCI Compliance Self-Assessment Questionnaire (SAQ), eliminating the Non-PCI Compliance Fee most merchants pay every month.

Benefits of Sage 100 Level 3 Processing

Sage 100 Merchants who process Level 3 transactions will save money with lower interchange rates than are available for Level 1 or Level 2 purchases. In addition, they receive detailed reporting that allows them to track transactions from beginning to settlement. Reporting can also be tailored with up to 60 different data points. Level 3 transactions typically cost a merchant 0.50-1.50% less than a standard Level 1 transaction, amounting to huge savings for B2B companies.

Qualifying for Sage 100 Level 3 Credit Card Processing

Level 3 credit card processing requires the capture of specific line item data in credit card transactions. These additional data fields include merchant name and address, invoice number and tax amount, plus line item details such as item description, quantity and unit of measure, freight amount, and commodity and product codes. The extra reporting makes it easier for corporate and government customers to monitor and track internal spending.

Several companies who use Sage 100 have already been using ClickToPay, and have seen the benefit of having AR Payments come in throughout the day without additional effort. If you’d like to turn this functionality on, or see a live product demo, please contact APS Payments at 1.888.685.1900.