Credit Card Processing Chargeback Process to Transition from Litigation Based to Liability Assignment Based Model

If you understand that “change is the only constant in life,” then it’s no surprise Visa introduced the new Visa Claims Resolution (VCR) on April 15, 2018 to simplify the credit card processing chargeback process. In business, change is often painful but required to adapt to the rising cost of doing business. Merchants are now figuring out how to adjust to this recent change that Visa made to the rules. We hope this blog helps assist you in your transition to the new rules in handling Visa credit card processing chargeback disputes and the new time-frames allowed to process those disputes.

4 Key Changes to the Visa Credit Card Processing Chargeback Process:

- Visa chargeback rules changed April 15, 2018

- Consolidation of Chargeback Reason Codes

- Reason Code 75 Eliminated (Transaction Not Recognized)

- Timeframe to dispute charges cut from 45 days to 30 days

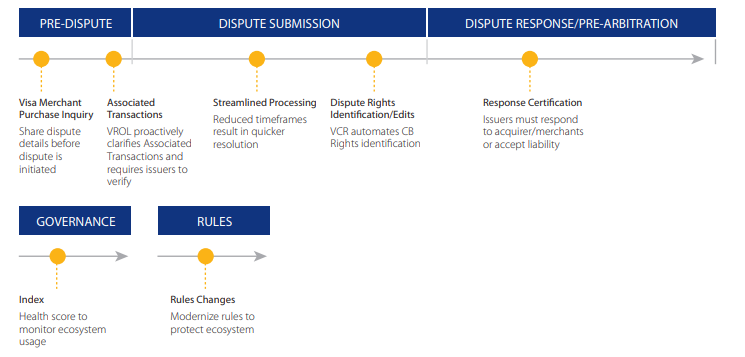

The purpose of the Visa Claims Resolution is to proactively eliminate invalid disputes and leverage existing data wherever possible. VCR provides Merchants with a guide to implement the enhanced dispute rules, streamline the process with reduced timeframes and offer enhanced tools for proactive resolution. Please visit this Visa link for more information: https://bd.visa.com/dam/VCOM/download/merchants/visa-claims-resolution-efficient-dispute-processing-for-merchants-VBS-14.APR.16.pdf

New Process

Consolidation of Credit Card Processing Chargeback Reason Codes

The 22 previous chargeback reason codes have been consolidated into 4 dispute categories as follows:

- Fraud including the following five dispute conditions:

- EMV liability shift, counterfeit fraud

- EMV liability shift, non-counterfeit fraud

- Other Fraud, Card Present Environment

- Other Fraud, Card Absent Environment

- Visa Fraud Monitoring Program

- Authorization

- Card Recovery Bulletin

- Declined Authorization

- No Authorization

- Processing Errors

- Consumer Disputes

- Processing Errors

- Late Presentment

- Incorrect Transaction Code

- Incorrect Currency

- Incorrect Account Number

- Incorrect Amount

- Duplicate Processing

- Paid by Other Means

- Invalid Data

- Consumer Disputes

- Merchandise / Services Not Received

- Cancelled Recurring

- Not as Described or Defective Merchandise/Services

- Counterfeit Merchandise

- Misrepresentation

- Credit Not Processed

- Cancelled Merchandise/Services

- Original Credit Transaction Not Accepted

- Non-Receipt of Cash or Load Transaction Value

Reason Code 75 Eliminated

Merchants will no longer be able to use the generic “Transaction Not Recognized” reason code. In the past merchants widely relied on this generic reason code to describe a transaction that did not fall into an available reason code. The purpose of retiring this reason code is in favor of streamlining the chargeback dispute process. Beginning April 15, 2018 issuers are required to leverage the data from the Visa portal to assist the cardholder to recognize the transaction as one falling in the 4 main dispute categories above.

Dispute Windows for Merchants Cut From 45 Days to 30

Previously Merchants had 45 days to respond to the initial dispute and resolution used to take up to 150 days to complete. Visa has reduced the timeframe for Merchant response to 30 days and resolution is expected within 31 to 70 days for Fraud and Authorization, 31 to 100 days for processing errors and customer disputes.

A portion of the information in this blog was extracted from a recent webinar hosted by Julie Fergerson, SVP Industry Solutions and Mike Pullen, Representments Specialist at Ethoca. You can listen to the webinar recording here: https://hs.ethoca.com/pymnts-what-you-dont-know-about-chargeback-rule-changes-can-hurt-you