Business-to-business (B2B) and business-to-government (B2G) purchases are increasingly being made via purchasing, corporate and business cards. The interchange rates for these types of cards traditionally have been some of the highest in the world. With that said, over the past several years, a new program has been created to help stimulate the American economy. Large corporations and government agencies have already began to take advantage of this program, significantly lowering their merchant account fees by utilizing a Level 3 gateway to process their B2B and B2G transactions.

Corporate purchase card transactions are priced differently from consumer credit card transactions. Getting the best rate for corporate purchases requires additional line item detail on each transaction. Because so much additional data is required, most merchants accepting Level 3 transactions integrate payment acceptance into their ERP System to eliminate manual entry of the line item detail.

At REPAY, we have already integrated our Level 3 gateway into multiple ERP and eCommerce platforms. Our PCI-compliant security solutions feature point-to-point encryption (P2PE), tokenization, and our APSPAYS Vault, eliminating card data that typically would be stored on a local server. We also walk our merchants through the PCI Compliance Self-Assessment Questionnaire (SAQ), eliminating the Non-PCI Compliance Fee most merchants pay every month.

Benefits of Level 3 Credit Card Processing

Merchants who process Level 3 transactions will save money with lower interchange rates than are available for Level 1 or Level 2 purchases. In addition, they receive detailed reporting that allows them to track transactions from beginning to settlement. Reporting can also be tailored with up to 60 different data points. Level 3 transactions typically cost a merchant 0.50-1.50% less than a standard Level 1 transaction, amounting to huge savings for B2B companies.

Qualifying for Level 3 Credit Card Processing

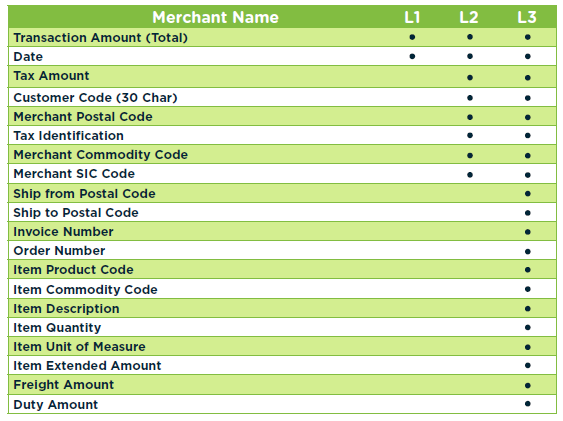

Level 3 processing requires the capture of specific line item data in credit card transactions. These additional data fields include merchant name and address, invoice number and tax amount, plus line item details such as item description, quantity and unit of measure, freight amount, and commodity and product codes. The extra reporting makes it easier for corporate and government customers to monitor and track internal spending.

Level 1 vs. Level 3

Level 1

“Level 1” card data is typically associated with consumer transactions (B2C) and provides limited purchase data back to the cardholder.

Level 3

“Level 3” (also known as Level III) line item detail is equivalent to the information found on an itemized invoice.

Comparative Example:

Download our Level 3 B2B Payments whitepaper to learn more!