Are you using payment technology to manage your loan portfolio effectively? A 2019 Experian study shows auto loan debt is at a record high. As an auto lender, your first thought might be, “Well, of course. Cars are more expensive, and more people finance them now.”

And you’re right. But the statistic leads to more critical questions. How are you managing that debt? How is your loan portfolio performing?

Whether you own all your paper or other investors and institutions do, portfolio performance is one of the most important metrics of your business.

According to Finder.com, the average loan balance from an independent dealer is $17,002, with an average monthly payment of $348. These numbers are slightly higher for a franchise dealer. Finder also states that there are over 100 million auto loans in the market, and according to the Experian study, new cars average a $32,000 loan balance with a $554 monthly payment.

You need to make sure you get paid. You want to be first in line after the mortgage or rent payment, not last or forgotten about because an auto-draft didn’t complete.

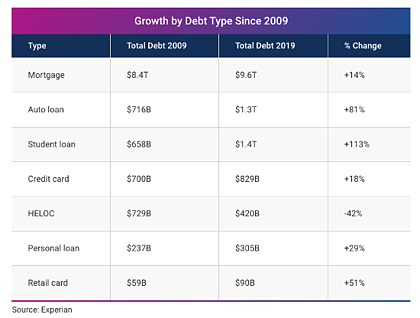

According to Experian, auto loan debt has grown to $1.3T, an increase of 81% over the past ten years.

While the debt numbers are higher, interest rates are, too. The Federal Reserve shows average auto loan rates are up ONE full percent since 2014. Rates now average 5.27% on 5-year loans, 102 basis points higher than the 4.25% in 2014.

With higher loan balances, monthly payments, and interest rates, it only takes one little blip to destroy your portfolio’s returns. Borrowers are also stretching their loan terms out longer than the typical 48 or 60 months.

We know people are borrowing more money and have higher outstanding balances than ever before. How are you making sure you receive those monthly payments?

Payments = Convenience & Speed

Enter payments for speed and convenience.

Many of your borrowers are millennials. As we discussed in a previous post, millennial borrowers need multiple convenient payment options.

You could offer card processing services and enable your borrowers to pay by credit, debit, and prepaid cards. The speed of card payments will enhance your collection efforts and reduce days past due (DPD) on your portfolio. Depending on state regulations, you may be able to collect a convenience fee to help offset the payment processing costs. Either way, card processing is a great option that makes sense for both you and your borrowers.

You can also implement an omnichannel payment strategy, enabling your customers to make payments through multiple integrated digital channels. Consider using SMS / text pay to send marketing messages and announcements, receive payments, and remind borrowers to pay. It’s an easy way to start a new conversation with your borrower. Good payers can get offers for their next cars, and slow payers can receive payment or past due reminders. A mobile app is another option that brings convenience to the payment experience. Borrowers can manage their accounts, view payment history, save payment methods, and schedule payments directly from the mobile app. In turn, you can send payment reminders and other messages via push notifications within the app.

If you are not offering multiple payment options for your auto loan portfolio or the loans you service on behalf of your lenders, then you are missing out on an opportunity to receive payments faster, easier, and before they become a collections issue. Reducing DPD, streamlining your receivables, and offering convenient payment methods to your borrowers is a win/win.