There is one question on everyone’s mind right now: what’s next? There’s just so much uncertainty about the near future. What new realities will COVID-19 bring?

Your credit union members are worried. Like most Americans, they have many expenses. Members have questions about mortgages, car loans, stimulus checks, and Paycheck Protection Program (PPP) loans, along with what will happen from here. And in these complicated times, they are hoping that you will be a true partner to them, acting in stark contrast to a more impersonal big bank.If you prioritize and increase engagement now, gaining your members’ trust and lessening their financial fears, your credit union will reap the benefits later.

Credit Unions Have Built-In Advantages to Big Banks

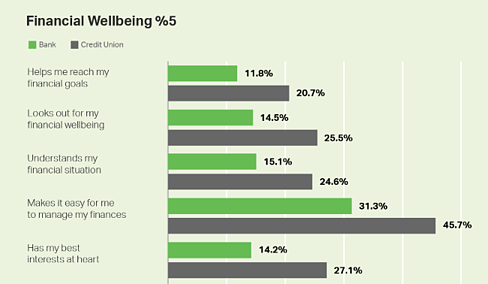

According to Gallup, only 14.5% of customers strongly agree that their banks look out for their wellbeing. Not surprisingly, credit union members think differently. About 25.5% of members believe their credit unions are doing what is best to support them.

Not only that, 45.7% of respondents think their credit unions make it easy for them to manage their finances.

Is your credit union outperforming the banks in this way?

Credit unions are much more likely to engage with their members and have member-centric products and services. This is something you should use to your advantage during this challenging time. Your members have real questions and want to engage with you. Never forget that an engaged member will not only buy more products and services, but also refer their friends and family members back to your credit union.

We want to make sure that you have the tools you need to engage your members!

The Time to Engage is Now

There has never been a better time to engage with your members. Why?

- Many are working reduced hours

- Many are working from home

- Many are distracted during work hours because the whole family is home together

- They are online much more than usual

- They are worried and have questions about the future

These five ingredients make it easier than ever before to reach out to your members online through messaging, web, email, or social media. Everyone is home, and everyone will see it. Marketing tech company LiveIntent is reporting a 5% increase in email opens due to COVID-19. The MessageGears platform is reporting increases, too -- open rates are growing each week!

As a credit union, you already have much higher open rates compared to a typical big bank. Your members want to hear from you. Make sure you use this opportunity to promote even higher engagement.

How to Engage

Here are three easy ways to engage with your members and ensure they feel a real sense of partnership.

Send Out a Survey

One of the best places to start is with a survey. Getting your members to answer an array of targeted questions about your credit union will increase engagement and provide you with valuable business insights. Whatever information you gain can be used to improve your products and services.

Invest in Mobile

Sometimes less personal engagement means more engagement overall. An investment in mobile technology is a great example. These days, it’s all about meeting your members where they are and where they feel comfortable – and that means going mobile. Mobile technology, through text pay or a mobile app, gives you direct access to your members. This form of communication and engagement fits right into their daily lives and comes across as less intrusive and more convenient than other types of communication. You could automatically send a text message after a loan payment asking your member how their payment experience was. Or maybe send a push notification through a mobile app three days before a payment is due to remind them to pay on time and maintain good credit. In turn, your members can quickly and securely submit a loan payment, check their balances, and save preferred payment methods through the mobile app.

Younger members, especially millennials, understand the immense value of a seamless digital experience. If they can bank from their phones and self-serve with account management and payment options, they’re happy. Not to mention, younger members are more likely to stay with a credit union using current technology.

Use New Tech Tools

New technology doesn’t only mean an updated mobile and digital experience. Many banks still use COBOL, old legacy systems, and software from the 1960s. Your credit union may be one of them, but it doesn’t have to stay that way. You, too, can access faster, more secure tech tools and offer a fully digital omnichannel experience. Maybe your credit union can implement a new computer language, or perhaps you need a more robust tech-focused payment platform.

Credit unions can provide many of the same advantages the trendy, streamlined fintech firms offer. Every tech tool implemented by a credit union is a chance to engage with members in a new and different way.

Surveying your members and staying in continuous touch with them via a modern mobile and digital experience will keep your credit union top of mind for all their financial needs. More engagement means more trust and more business. And there is no better time to engage with your members than right now.