Take advantage of one of the few times of year you KNOW your customers have money for both down payments and loan payments.

The average tax refund last year was $2,869, according to Marketwatch.

As auto dealers, you know cars are only getting more expensive as manufacturers add more desirable technology and features. Tax season is a prime opportunity to target some of your prospects and turn them into buyers as they use their refunds to buy cars.

For most people, money is still very tight, and saving can be tough. According to two studies, Turbotax Free filers and the IRS VITA (Volunteer Income Tax Assistance) Program, almost half of the respondents said they needed their tax refund money for necessities, such as groceries, bills, or rent.

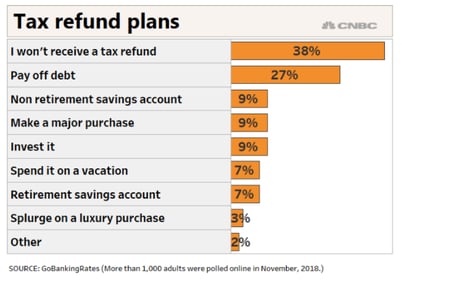

CNBC expects the refund number to be just a little bit higher this year at $3,100. CNBC also reports only 10% of refund recipients expect to use the money for investments. eBay conducted its retail study and found 37% of millennials receiving refunds are planning to spend the money on purchasing cars.

That means there are going to be a lot of potential car buyers out there. Make sure you don’t miss this opportunity.

Reap Two Huge Benefits

Per the IRS and Turbotax studies, almost half of respondents do not need their refunds for necessities, which means there will be a lot of people with money to spend on a car. Your dealership can benefit in two ways, as buyers:

- Make down payments for a car purchase (9% are expected to make a major purchase and cars definitely qualify, according to the CNBC article)

- Pay down debt, including existing auto loans customers have with you (the #1 expected use of tax refunds this year)

Check out the chart from CNBC with information provided by a GoBankingRates poll:

While using the refund for down payment money is easy to understand, if you hold a loan portfolio of any size, you could get a big bump in yield by receiving an early payoff. This might be even better for your dealership than customers using the money to buy a new car. The option of rolling over this loan into a bigger loan for a creditworthy buyer is a win/win, too.

Are you Ready?

There are lots of things to consider as we enter the peak of tax season. Do you have a marketing plan to target early payoffs or rolling a loan payoff and trade-in into a bigger, more expensive car? Do you have easy and convenient payment options allowing your new and existing customers to make down payments and loan payments?

To capitalize on tax season, you need to be sure you never miss a payment opportunity. The most basic place to start is ensuring you can accept payments via debit/credit cards, prepaid cards, and ACH/bank accounts. The next step is thinking beyond your normal business hours and beyond the physical boundaries of your brick and mortar dealership. Can your customers make loan payments online, on a mobile app, or via text or Interactive Voice Response (IVR/phone pay)? It’s important to make the payment process as convenient as possible so you don’t miss cashing in on that tax refund.

Other points to consider during this time have to do with prepayments. Do the loans you hold in-house have a prepayment penalty? What about your best lending partners? Do you use precomputed interest? If there is a charge for prepayment, no matter how small, then your portfolio can:

- Earn fees from the penalty

- Earn other fees related to the loan payoff

- Use the funds to lend to a new borrower at a possibly higher interest rate

- Roll this balance into a new bigger loan for the same borrower

The numbers are clear. In Q4 of 2019, household debt crossed $14 trillion, an all-time high, according to Reuters. Many families do not have extra money sitting aside for a car. The one significant opportunity you have to collect loan payments or get customers into a new car is during tax refund season. Don’t miss it!