Auto lenders are facing a big problem: credit quality is deteriorating. Private lenders and buy here pay here lenders are getting hit the hardest.

If you haven’t suffered yet, higher than average delinquencies are probably coming your way.Auto loan originations have hit an all-time high of $584 billion. At the same time, the Motley Fool reports that 7 million Americans are more than 90 days late on their auto loans, which accounts for almost 6.5% of all auto loans across all credit grades. Bloomberg describes the problem as the highest auto delinquency levels since 2012. More people are now behind on their auto loan payments than during the Great Recession.

The bottom line: bringing the deals in is no problem, but making sure your portfolio stays current might be.

If you are an independent auto lender, you need to proactively manage your portfolio, or it could get away from you. REPAY has the tools to help you – you don’t have to go at it alone.

Not All Credits Are Impacted

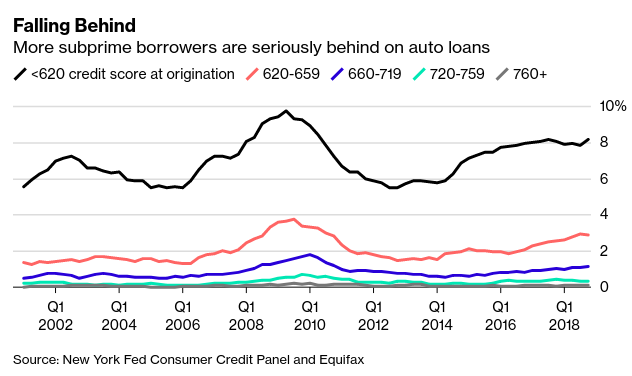

The Motley Fool article states that only 1% of credit union held auto loans are delinquent. On the other hand, 6.5% of those held by all private auto finance companies are delinquent. How can this be? Credit unions usually have older and more credit savvy borrowers with higher credit scores. Everyone isn’t getting hurt equally. The Bloomberg article breaks it down by credit grade with a chart from the NY Fed:

This chart shows that loan performance is essentially the same for credit scores of 660 and higher. For scores ranging from 620-659 (the red line), there is a definite uptick from 2% in Q1 2016 to more than 3% in Q1 2018. The biggest change in delinquencies is for credit scores under 620, or sub-prime borrowers. You can clearly see the trend has been sneaking upwards since 2014, and 8% of all sub-prime auto loans were delinquent in Q1 2018.

As an auto lender, the more sub-prime borrowers you have, the more susceptible your portfolio is to these economic trends.

How Many Ways Can Your Borrowers Pay?

This may sound like a silly question, but most auto lenders only accept payments via checks or ACH/automatic drafts out of customers’ bank accounts. If borrowers are lucky, the more ‘tech-savvy’ lenders let their customers go online to make one-time payments. For many auto lenders, the way borrowers can pay in 2019 is not that different than the way they paid in 1989. Offering multiple convenient ways to pay can be a game-changer and significantly reduce the chance of delinquency.

Do you have an online portal where your borrowers can set up recurring payments, not just one-time payments? Can your borrowers make payments with their debit cards or bank accounts 24/7/365, even when your business is closed? With an online web portal, customers can self-serve and “set it and forget it” by scheduling recurring payments.

Do you have an app or text pay so your younger borrowers can pay on their phones?

Some late payments are simply due to forgetting what day it is. You can prevent these late payments with an app that pushes notifications to your customers’ mobile phones on a customized schedule before payments are due. Text pay allows you to send payment reminders and lets your customers initiate and authorize payments with a simple text message. Wouldn’t you like to be top of mind when it comes time for borrowers to choose which bills to pay first?

Answering ‘yes’ to any of these questions could mean lower costs of managing your receivables, a more streamlined approach to your portfolio, and enhanced returns.

Conclusion

Thanks to online portals, mobile apps and other payment technology tools, there are a ton of ways for auto lenders to get paid. You simply have to implement these methods.

If these new payment methods meant

- less effort spent on chasing down payments

- lower delinquencies

- higher returns and

- fewer collections employees (or fees to an outside party)

…then why wouldn’t you use them?

The economic environment is only getting more difficult for ensuring you collect on what’s due to you. Make it easier for yourself by embracing modern payment technology methods.