Thanks to the fintech industry, more firms are making more consumer loans at lower interest rates than ever before.

Markets for consumer lenders are competitive both among the fintech newcomers and incumbent lenders. Fintech lenders, in particular, are looking for an advantage in the marketplace. Just providing a service the traditional banks don’t offer isn’t enough to make lenders stand out anymore. Now big banks are jumping into fintech style lending services as evidenced by Wells Fargo’s FastFlex and Goldman Sachs’ Marcus.

How does a fintech lender compete with the billions of capital the large traditional banks have at their disposal?

Fintech lenders rely on technology and use it as a competitive advantage. One way they can maintain an edge is integrating better technology into their payments systems. Push payment technology represents a huge opportunity in today’s lending climate.

Push Payments v Pull Payments

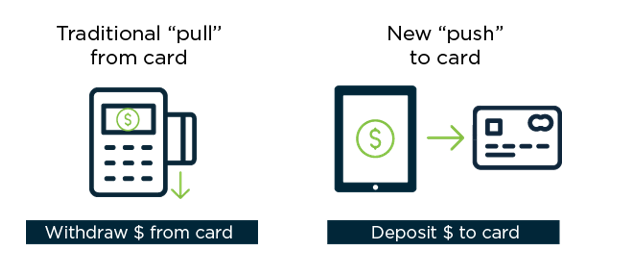

Both pull and push payments are opportunities to make payments faster, easier, and cheaper for lender and borrower alike. A pull payment is standard for payments processing. In this case, the payment starts with the lender. The lender pulls the money from the borrower’s account after the borrower provides all necessary information and payment authorization. This is also known as a debit transfer.

A more recent innovation is push payments or credit transfers. A push payment is when the borrower sends the money directly to the merchant one time or on a recurring schedule. Lenders can also push funds to a borrower’s prepaid or debit card. There are huge implications and opportunities for push payments within the consumer and B2B industries. According to Visa, push payments represent a $10 trillion opportunity in the United States. By using push payments, settlement times are faster, and costs go down.

Visa and Mastercard Offer It, But Your Processor Might Not

Visa Direct is one of the key programs in push payments that benefits lenders, yet Visa doesn’t offer the program to everyone. The payments processor must have access and the technological capability to connect to Visa Direct. Visa’s SVP of Push Payments, Cecilia Frew, described the program to LendIt as ‘a real-time push-to-card payment solution that enables online lenders to approve loans and deliver funds the same day' in what projects to be a $62 billion market of originations for digital lenders by 2021.

Mastercard also has a push payments program, Mastercard Send, where it allows lenders to push a payment or disbursement to a customer’s prepaid card or

bank-issued debit card.

The real-time processing and funding of push payments will eliminate the waiting period associated with ACH and paper checks. When using these traditional options, consumers must wait up to 7 days for the loan to close and fund. Few payment processors in today’s market offer Visa Direct or Mastercard Send to their customers, but it would make sense for all consumer lenders and online lenders to have the push payment capability.

Push Payments for Loan Disbursement

Imagine if your loan product is actually a line of credit instead of an installment loan. This would mean that each month as the line is used and paid down, that credit is available to borrow again. Your best borrowers can borrow faster. Credit line lenders can start this process with borrowers and generate interest fees faster thanks to push payments.

How?

The push technology allows a lender to push the funds to borrowers’ debit or prepaid cards for real-time funds disbursements, which they can start using right away. Uber, for instance, uses Mastercard Send (see study p. 4) to pay its drivers. Not only do the drivers NOT have to wait a week to get paid, they use their debit cards 20% more often

and spend 20% more in the following four months.

If you were a lender and could get your best borrowers using your funds to generate interest faster and in higher amounts, wouldn’t this be a win/win? Speed and convenience for the borrower, higher interest and loan fees for you, the lender.

SMB lender, Kabbage, and Retail Point of Sale lender, LendingPoint, use push payments to offer real-time funding to their borrowers. Both get the loan proceeds into the hands of borrowers faster and clearly position the push payment technology as a selling feature against slower funding competition.

Minutes after credit-worthy borrowers are approved, their loans can fund. Minutes after funding, borrowers can start using the proceeds. Many aspects of approving and closing a loan become easier with the technology behind push payments. If you are a lender, this is a tool you need in your toolbox.