For your collections business, we’re sure you’d agree that you need to collect faster on your portfolio to make more money.

When your agency is earning contingency fees from clients or tracking payments made when you buy or service a portfolio, speed is vital for good returns. The more calls you have to make, the more time you have to invest in collecting, the lower your returns. The more your staff has to work to collect the same amount of money, the lower your returns. You get the picture.

And we don’t have to mention what happens when debtors impose call cap limits on you. What you need is simple, fast closing on as many debt accounts as possible.

How can you collect more in less time?

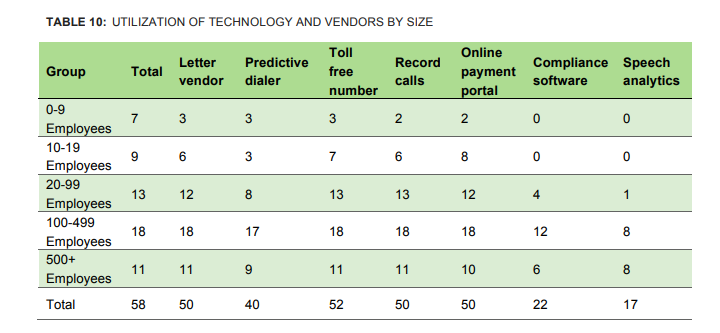

Payment technology enables faster payments, and we know that almost every collection agency out there has an online payment portal if it has near current software. But what about other ways to pay?

More payment processing options and intelligent payment technology give debtors more ways to pay faster, enhancing your returns. Let’s see what other firms in the industry are doing.

Comprehensive CFPB Study of Collection Firms

In July 2016, the Consumer Financial Protection Bureau (CFPB) released a comprehensive, voluntary study of the collections industry. Fifty-eight firms of all shapes and sizes – from law firms to very small businesses of less than 10 employees to huge collection agencies – participated and shared information with the Agency on how they do business. Here is a copy of the study you can check out for yourself.

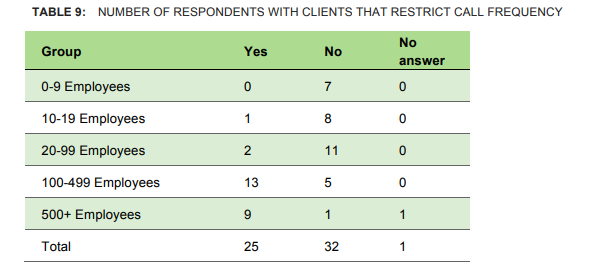

In the study, 43% of firms reported debtors imposing call limits on them. Imagine eliminating this as an issue…

From the chart, you can see that the larger the collection agency, the more likely a call cap came into play. Is that because larger agencies have bigger clients who may know about FDCPA rules? Or maybe smaller agencies have less debt savvy customers who don’t know the call cap rule?

Payment Technology = More Options

While accepting debit and credit card payments via an online portal or over the phone is standard for collection firms, there are many other great options on the table. You need to offer choices and allow debtors to make payments through:

- ACH

- Voice Recognition Software over the phone (it’s called IVR)

- Text to Pay

- Smartphone Apps

The good news is that tech-oriented payments firms will give you access to all these payment methods, while offering the standard methods like online portals. Some companies offer even more advanced options and enable consumers to pay through their mobile apps, or they can help you develop your own app. A tech-driven payment processor means one account for all these payment options, which keeps things simple and straightforward.

In the CFPB study, 86% of firms surveyed had an online payment portal, but they had to pay an average of $50 per month in additional fees for an ACH gateway and another $30 per month for credit card processing (CFPB Study, p. 33-34). These fees are paid to the different firms before the first transaction ever goes through their systems.

Does your firm have multiple payment options like these?

With IVR, for instance, one of your employees could negotiate a deal with a debtor and then immediately move the debtor to the IVR software prompts within the same call. While your employee calls the next debtor, a payment is made from the first debtor in a one call close. Take your payment technology one step further and employ a virtual debt collector tool that will automatically negotiate the deal and accept a payment without any employee interaction.

This is maximum time management and effectiveness of your staff AND you are collecting more money faster from a one call close. Consider how much more business your staff can do with easier payment options and more advanced technology.

Some other questions to consider to increase your speed of collection include:

- Is your payments platform integrated with your collection management software?

- Are you giving the debtors many convenient options to pay?

- Is your payments platform up to the task to enable one call closing with ease for the debtors?

Payment processing has advanced far beyond swiping a card in a physical terminal. For collection firms, this is an opportunity to take advantage of the better technology out there. Processors today can handle multiple payment options faster, enabling one call closing by your staff for maximum effectiveness and ROI for your firm.