Our appetite for borrowing only continues to grow, Coronavirus or not.

Debt levels are rising despite what has been eleven years of favorable economic performance. That was before the Coronavirus outbreak. Borrowing demand, however, is likely to remain strong, if not just a little delayed, despite the forced global slowdown.

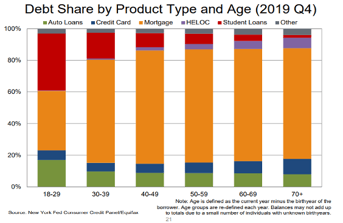

Credit cards are a big piece of that debt. After home, car, and student loans, credit cards are the next biggest debt category (see the blue in the chart below). With rising credit card balances comes more interest in debt consolidation loans provided by fintech lenders like Lending Club, Prosper, or SoFi.

The New York Fed Report on Household Debt 2019

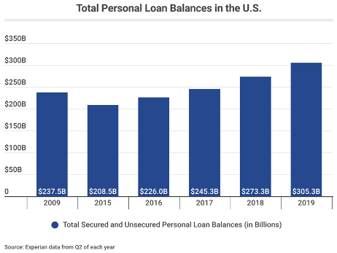

Based on an Experian study from 2019, The Motley Fool reports personal loan debt is the fastest-growing type of debt. Personal loan debt growth of 12% is double the growth of the next biggest category, credit card debt. The average borrower has a $16,000 loan balance.

Experian

The need for personal loans and debt consolidation will continue to exist, virus or not. In fact, the demand could grow due to the new economic environment.

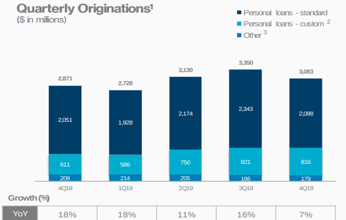

Lending Club’s Growth Numbers

Lending Club is one of the lending leaders. Since they are publicly traded, we can get a good snapshot of the industry by looking at their numbers. From their last quarterly earnings report (slide 13), we can see the growth of demand for personal loans quarterly and a year over year (YoY) comparison to 2018.

The loan origination numbers here are in the millions of dollars. Lending Club is averaging between $2.7 billion and $3.35 billion in originations per quarter. The total for 2019 is a little over $12 billion. Not only is that a lot of loans, but the YoY growth is double-digit in four of the past five quarters. People’s appetite for borrowing isn’t slowing down.

And then there’s the virus.

Effects of the Coronavirus

Many U.S. cities are on some form of quarantine or lockdown, meaning people are going out less. As we write this, bars and restaurants are closing or converting to carry-out only service in cities, both big and small. But loans and other debts must continue to be paid unless a temporary suspension of payments goes through Congress.

And while the appetite for borrowing hasn’t changed yet, people’s behaviors have. Those used to going out and making a payment at a bank branch or in some other point-of-sale manner are now staying home. They need to find different ways to accomplish the same tasks.

On the bright side, the internet and digital payment options continue to function properly. If they were going to overload and malfunction, as we’ve seen with the Robinhood stock trading app, we would have seen and heard of it by now.

Digital payment options like online, text or SMS, and interactive voice response ensure customers can make payments virtually, and businesses can get paid. Companies with more available and flexible payment options will be rewarded during this unprecedented time. Your flexibility in this area will increase your cash flow.

Despite having to put new policies in place (like working from home, shorter hours, reduced staff, etc.), you have a business to run. You need to get paid. As a lender, many people are relying on you during this time.

- Your employees need to get paid, so their lives aren’t disrupted too much more than they already are.

- Your future borrowers are relying on you for much-needed funds.

- While perhaps delayed, many of your borrowers are still getting paychecks and want to pay what they have promised. Many are hoping to maintain or improve their credit standing.

- Your shareholders are looking for smart, careful management of their investments during a difficult time.

Make it easy for borrowers, especially now, by giving them as many options as possible.

As behaviors change due to the virus, there’s a good chance people will be spending less. But that will probably have little effect on the demand for personal loans, especially for debt consolidation. Odds are demand will stay strong. When things normalize, people will want to borrow. Flexible payment systems are one way, along with solid underwriting and portfolio management, that you can continue to originate quality loans and keep your business running smoothly.